ABOUT

Femto’s approach to maximizing

Japanese startup investment opportunity

-

Identifying Transformative

Leaders & Supporting MBOsWe focus on discovering leaders within startups and Management Buyouts (MBOs) who have the potential to bring about significant change in their respective industries. We provide strategic support and guidance to MBOs, helping them adjust and adapt to the dynamic business environment.

-

Participating as Lead Investor

Upon investment, we create financial schemes and structures that could make high returns to start-up’s management based on our technical expertise on financing, capital policies, preferred shares, etc. As lead investors, we are in a position to greatly influence their growth and trajectory, emphasizing our industry-agnostic approach.

-

Offering Strategic Support

Our team provides the financial strategy and expertise to optimize their leadership and unique competencies. Beyond providing substantial financial backing, we extend our support to include strategic guidance. We work closely with the leaders of these startups, offering financial and strategic insights that are tailored to their unique needs and issues.

Investment Strategy

We make substantial investments ranging from JPY 200-700 mil (approximately $1.8M - $6.3M) to potential startups mainly in the seed – early stages in Japan.

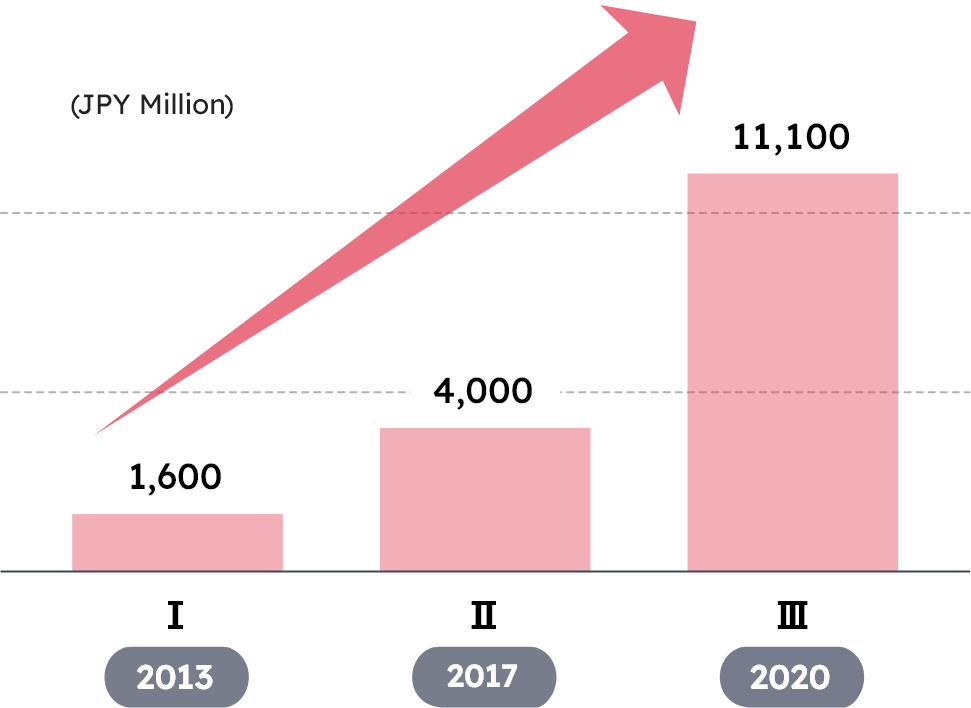

Rapidly expanding

fund size

We boast a solid portfolio with multiple funds totally exceeding JPY 16,000 million and growing in size, two Initial Public Offerings (IPOs), and numerous investee companies.